x.com

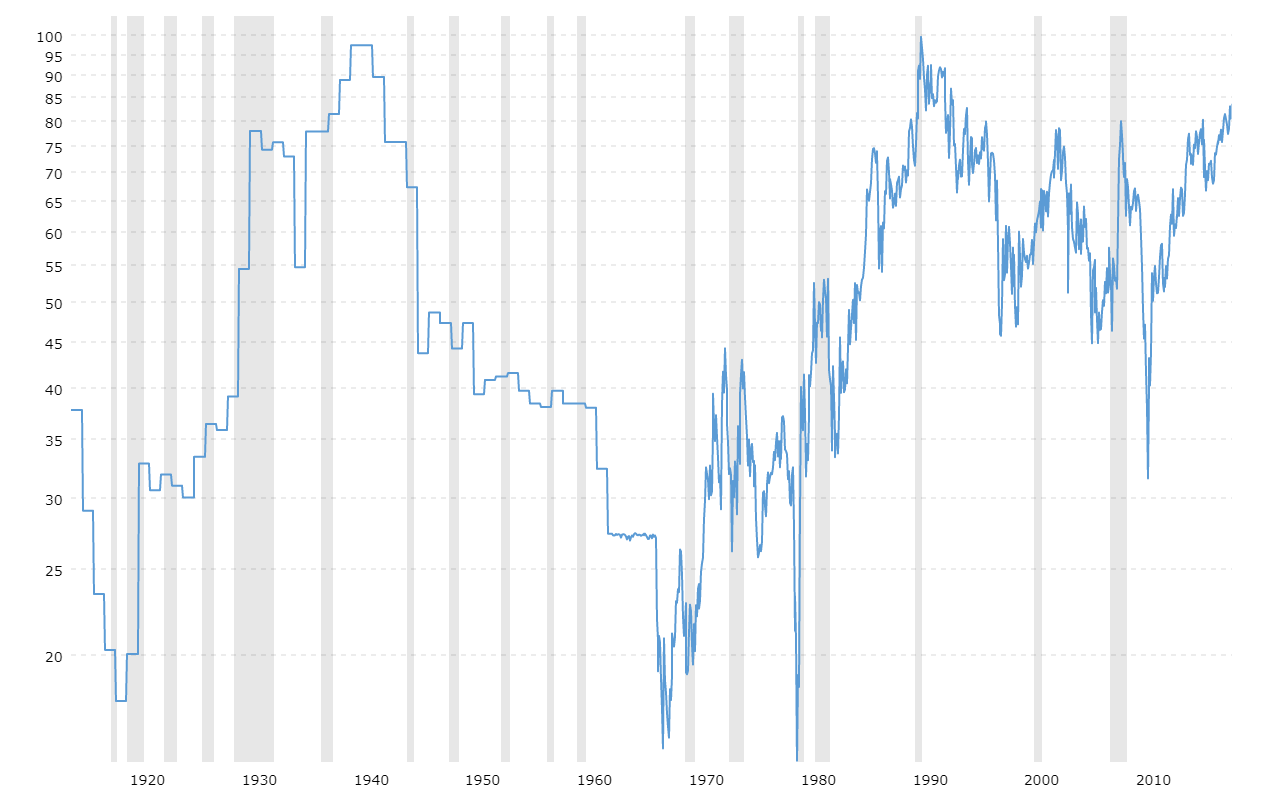

Gold to Silver Ratio - 100 Year Historical Chart

This interactive chart tracks the current and historical ratio of gold prices to silver prices. Historical data goes back to 1915.

Gold is trading at almost 100X silver. Silver is undervalued and will likely catch up in a few years. Most likely it will double. In a market where there is a lot of uncertainity and everything is overvalued, I definitely would start a position in silver. The US debt crisis could be devastating to the economy and markets, and silver is a good hedge. With Trump causing chaos, world economies collapsing, and unstable geopolitical events worldwide, it's important to protect your assets against a market crash.

Once I cash out my bitcoin, I plan to allocate approximately 10-20% in silver.

Precious metals are generally only used to maintain value in relation to inflation. That is, they don't gain or lose intrinsic value, but since fiat is devalued due to governments printing more money, it takes more fiat to buy precious metals that have maintained their value. However, when a precious metal is undervalued, or there there is great uncertainity and risk, it could be a wise choice to add it to your portfolio. Bonds are useless if inflation persisists and governments raise rates.

Last edited: