SIMPLICIUS

APR 03, 2025

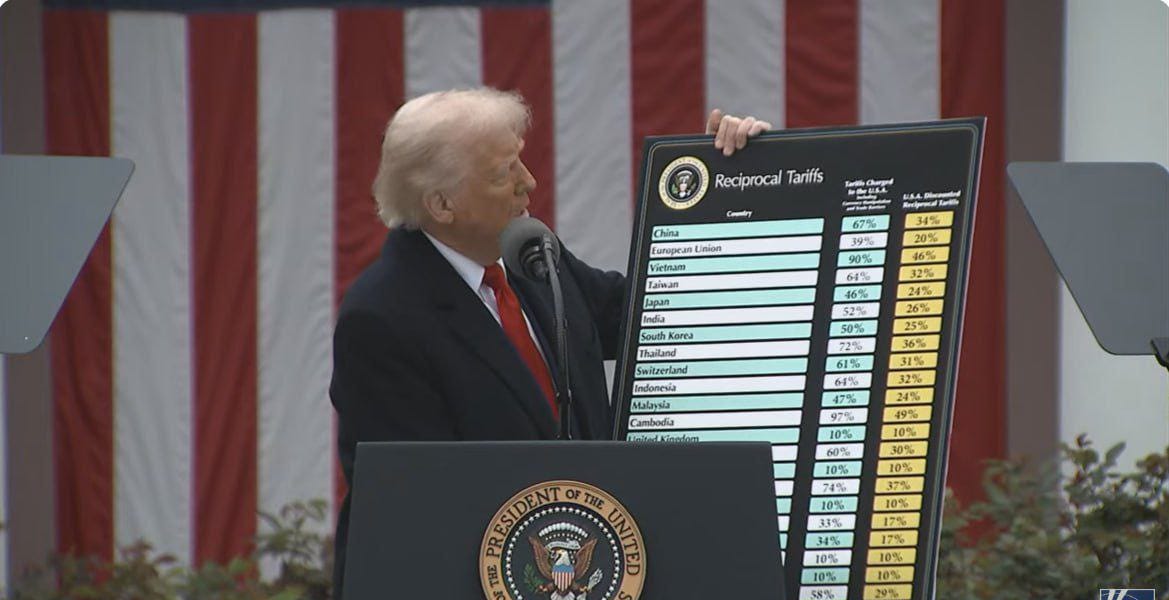

The grand new American reawakening has come, Trump announced with his inaugural ‘Day of Liberation’—a Declaration of Economic Independence:

Experts the world over are now butting heads over what this epochal ‘reciprocal tariffs’ package will mean for the world economy.

Firstly, it must be said that the misnomered program is apparently not one of ‘reciprocal’ tariffs at all, but rather tariffs doing the job of balancing ‘unequal’ trade deficits between the US and other countries. As most know by now, Trump’s team apparently used a simple equation for determining the tariff rate:

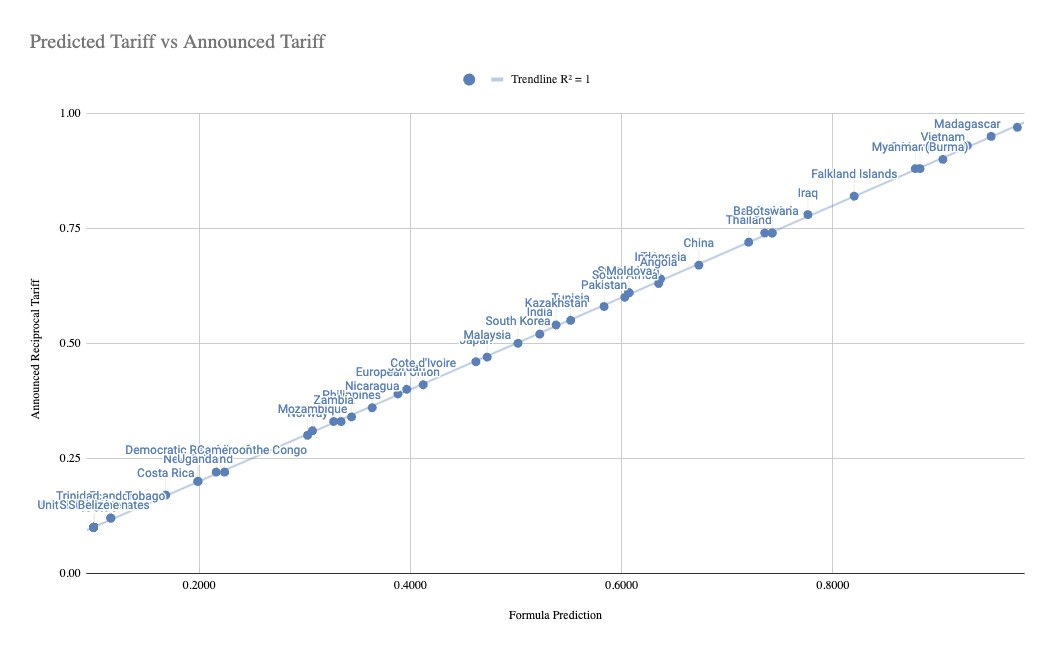

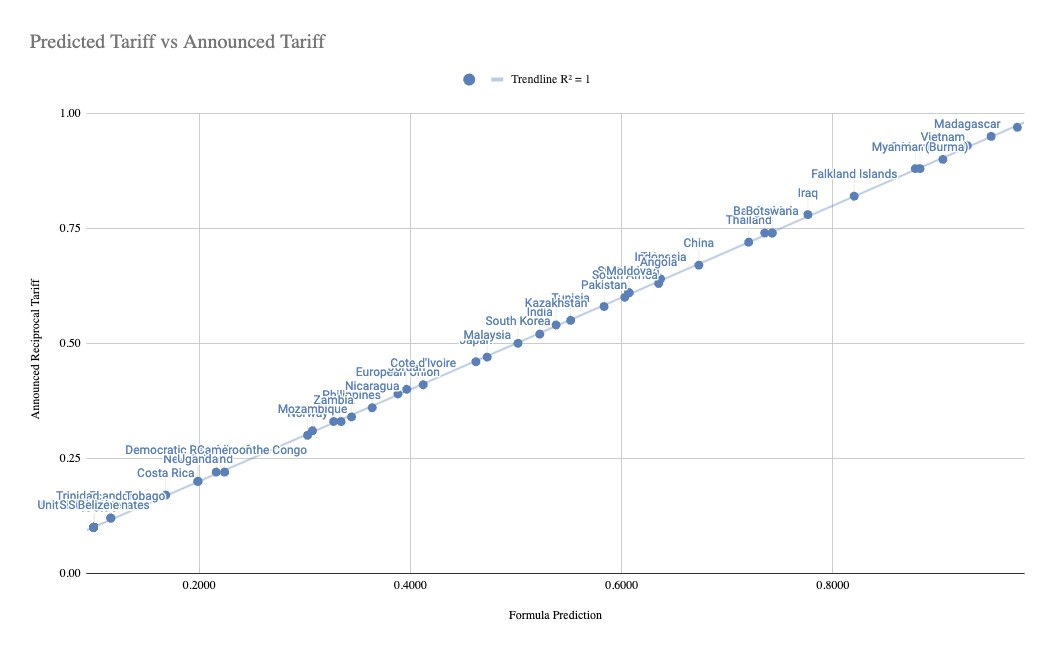

Flexport's team was able to reverse engineer the formula the Administration used to generate the "reciprocal tariffs." It's quite simple, they took the trade deficit the US has with each country and divided it by our imports from that country. The chart below shows the predictions of this formula plotted against the actual new tariff rates.

Not surprisingly there was an early bloodbath in the markets, with the US dollar dramatically falling against major currencies:

The US dollar fell against major global currencies, including the euro, Japanese yen, Swiss franc, British pound and Russian ruble. However, it strengthened against the Chinese yuan. The decline against the euro is the largest in the last 10 years, over 2%.

But this may all be part of the Trump plan. Jumping to conclusions has become second nature in our modern information field, with instant gratification culture requiring immediate results at all times. Truly epochal shifts take time to turn things around, and come with great short-term pain; that’s only natural when undoing decades of economic fraud.

It turns out Trump’s entire game plan may have been taken from economic advisor Stephen Miran’s playbook. In November, Miran wrote A User’s Guide to Restructuring the Global Trading System, which according to experts precisely parallels what Trump is now attempting to carry out. One of the core tenets of the document is the deliberate devaluation of the US dollar in order to make US exports favorable again to reignite American manufacturing. The entire issue revolves around the famous Triffin’s dilemma, which notes:

A country whose currency is the global reserve currency, held by other nations as foreign exchange (FX) reserves to support international trade, must somehow supply the world with its currency in order to fulfill world demand for these FX reserves. This supply function is nominally accomplished by international trade, with the country holding reserve currency status being required to run an inevitable trade deficit.

To summarize the above for the laymen, a country which holds the world’s reserve currency faces a significant dilemma wherein its national trade policy and monetary policy are effectively at odds against each other. In order to keep its currency as reserve status—and reap all the geopolitical benefits this creates—the country must hamstring its own economic output by running a huge trade deficit, which means the country imports far more than it exports, which hurts—or in the case of the US, kills—domestic manufacturing.

Why must a country run a trade deficit to retain its global reserve currency status? Because when your currency is the global reserve currency, the entire world constantly hungers for it in order to use it in all the various countries’ international trade between each other. The only way to keep those countries constantly supplied with dollars is for Americans to buy tons of foreign imports, which effectively sends dollars to those countries, since these purchases are made with dollars. If the countries instead bought a ton of US exports, they would be paying for those exports with dollars, which means all the dollars would be sent back to the US, and global nations would have a severe lack of US dollars. What would happen then? They would have no choice but to trade with their own currencies, which would mean the collapse of the dollar reserve system.

A simpler example: if a French person buys a $50,000 Ford truck and imports it to France, that’s $50,000 USD that leaves France and goes back to the US, lowering France’s dollar holdings. If an American buys a $50,000 French Peugeot to import it to the US, he sends his $50,000 USD to France, which increases its dollar holdings.

As seen, the only way to maintain the dollar’s reserve status is to make sure US dollars are constantly flooding the world, which can only be done by running a massive trade deficit where imports of foreign goods (outflow of USD) far outweigh exports of domestic goods (inflow of USD).

This contextualizes the Miran paper’s focus on the ‘overvaluation of the dollar’, particularly from the aspect of national security. Miran rightly notes that US national security is degraded in the current circumstances, by the erosion of manufacturing potential which leaves the US incapable of producing its defense imperatives. Miran’s thesis further provides for the tariffs being a tool not merely as some quick-and-cheap form of ‘revenue’, as some assume, but for the purpose of favorably rebalancing global currency valuations.

Tariffs as a Lever: Tariffs are a primary tool to address trade imbalances, not just for revenue but to force currency adjustments and protect domestic industries.

And the above does not mean Trump’s latest move intends to bring an end to the dollar reserve system. On the contrary, he intends to continue it in a more ‘fair’ manner. From the paper:

Despite the dollar’s role in weighing heavily on the U.S. manufacturing sector, President Trump has emphasized the value he places on its status as the global reserve currency, and threatened to punish countries that move away from the dollar. I expect this tension to be resolved by policies that aim to preserve the status of the dollar, but improve burden sharing with our trading partners.

For the crowd which crows that tariffs hurt the American consumer, who is forced to bear the burden of the costs, the paper outlines how that may not be the case:

In essence, the devaluation of foreign currency can offset the duties on imports. You’ll note this appears to contradict the premise of devaluing the dollar as well, but that’s where it gets much trickier. As I understand it, the paper proposes to strike a fine balance, explaining that if adversarial countries choose to devalue their currencies as a reaction—to boost their own exports—the pain could be ‘offset’ by the explanation above. Friendly countries, on the other hand, could agree to help devalue the dollar in what Miran imagines as a ‘Mar-a-Lago Accords’ agreement, akin to the Plaza Accords, or even the Bretton Woods agreement.

Miran also envisions the tariffs as just the first stage of a more elaborate operation. The tariffs could be used merely as the initial bullwhip to bring countries into negotiations, wherein Trump will then switch to a carrot-on-stick approach in alleviating or removing tariffs on countries which agree to finance ‘significant industrial investments’ into the US manufacturing sector.

Because of this, different stages of the process are expected, like the dollar first strengthening, then eventually weakening:

In any case, because President Trump has shown tariffs are a means by which he can successfully extract negotiating leverage—and revenue—from trading partners, it is quite likely that tariffs are used prior to any currency tools. Because tariffs are USD-positive, it will be important for investors to understand the sequencing of reforms to the international trading system. The dollar is likely to strengthen before it reverses, if it does so.

Miran does note the dangers, however:

Fourth, these policies may supercharge efforts of those looking to minimize exposure to the United States. Efforts to find alternatives to the dollar and dollar assets will intensify. There remain significant structural challenges with internationalizing the renminbi or inventing any sort of “BRICS currency,” so any such efforts will likely continue to fail, but alternative reserve assets like gold or cryptocurrencies will likely benefit.

Now the main argument revolves around whether US has a manufacturing backbone to even revive anymore. Many argue that at this point, things are ‘too far gone’—infrastructure has crumbled for too many decades, entire generations have lost the knowledge to build things, and perhaps worst of all, the culture in America has dwindled to become a kind of poisoned well that has disincentivized the newest generation of men from taking the types of jobs that would lead to some imagined manufacturing boom or golden age.

As one thread propounds:

In 1973 the US produced 111.4 million tons of steel. It employed 650,000 people. The industry now employs 142,000 and the US produces 79.5 million tons - which admittedly is better than the nadir of only 60 million tons under Reagan

Figures I’ve seen suggest there are now nearly 5 million less workers in the manufacturing sector than there were in the year 2000, despite the fact the US population has grown by a whopping 60 million people since then.

In many ways, what Trump is attempting to do is strongarm the world into a modern form of imperial neo-feudalism, where vassal states pay handsomely for the privilege of lowering their ‘protection’ racket fees. Some will argue this is an equitable system; in Anglo terms, perhaps. China envisions quite a different global order, without the need for mafia threats and coercion.

Also important to note is that Trump’s multi-phase plan includes the gradual replacement of the IRS with the ERS—or External Revenue Service. Trump’s Secretary of Commerce Howard Lutnik said as much many times, with increasing emphasis most recently; listen to the two clips below:

Trump makes a bit of a mistake in the end of his statement above—he claims tariffs would have saved us from the Great Depression, omitting that the infamous Smoot-Hawley tariffs in fact desperately tried, and arguably made things worse. He corrects himself, but says by then it was “too late” to act—a damning appraisal just as easily levied on his own nascent attempts to intervene at the Empire’s terminal arc.

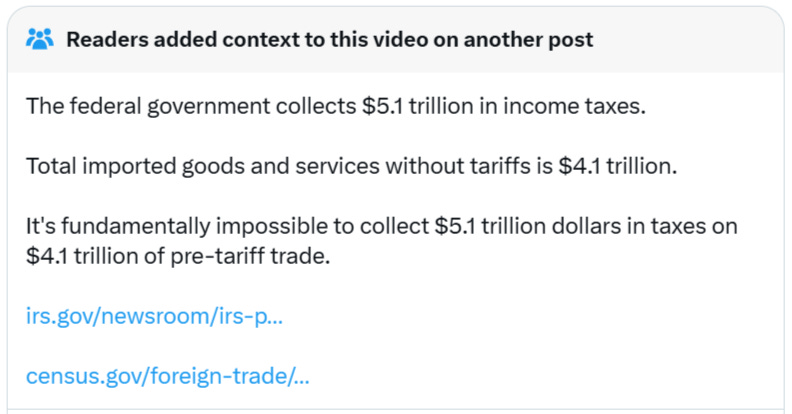

A ‘fact check’ claimed it would be materially impossible to replace tax revenues with tariffs:

APR 03, 2025

The grand new American reawakening has come, Trump announced with his inaugural ‘Day of Liberation’—a Declaration of Economic Independence:

Experts the world over are now butting heads over what this epochal ‘reciprocal tariffs’ package will mean for the world economy.

Firstly, it must be said that the misnomered program is apparently not one of ‘reciprocal’ tariffs at all, but rather tariffs doing the job of balancing ‘unequal’ trade deficits between the US and other countries. As most know by now, Trump’s team apparently used a simple equation for determining the tariff rate:

Flexport's team was able to reverse engineer the formula the Administration used to generate the "reciprocal tariffs." It's quite simple, they took the trade deficit the US has with each country and divided it by our imports from that country. The chart below shows the predictions of this formula plotted against the actual new tariff rates.

Not surprisingly there was an early bloodbath in the markets, with the US dollar dramatically falling against major currencies:

The US dollar fell against major global currencies, including the euro, Japanese yen, Swiss franc, British pound and Russian ruble. However, it strengthened against the Chinese yuan. The decline against the euro is the largest in the last 10 years, over 2%.

But this may all be part of the Trump plan. Jumping to conclusions has become second nature in our modern information field, with instant gratification culture requiring immediate results at all times. Truly epochal shifts take time to turn things around, and come with great short-term pain; that’s only natural when undoing decades of economic fraud.

It turns out Trump’s entire game plan may have been taken from economic advisor Stephen Miran’s playbook. In November, Miran wrote A User’s Guide to Restructuring the Global Trading System, which according to experts precisely parallels what Trump is now attempting to carry out. One of the core tenets of the document is the deliberate devaluation of the US dollar in order to make US exports favorable again to reignite American manufacturing. The entire issue revolves around the famous Triffin’s dilemma, which notes:

A country whose currency is the global reserve currency, held by other nations as foreign exchange (FX) reserves to support international trade, must somehow supply the world with its currency in order to fulfill world demand for these FX reserves. This supply function is nominally accomplished by international trade, with the country holding reserve currency status being required to run an inevitable trade deficit.

To summarize the above for the laymen, a country which holds the world’s reserve currency faces a significant dilemma wherein its national trade policy and monetary policy are effectively at odds against each other. In order to keep its currency as reserve status—and reap all the geopolitical benefits this creates—the country must hamstring its own economic output by running a huge trade deficit, which means the country imports far more than it exports, which hurts—or in the case of the US, kills—domestic manufacturing.

Why must a country run a trade deficit to retain its global reserve currency status? Because when your currency is the global reserve currency, the entire world constantly hungers for it in order to use it in all the various countries’ international trade between each other. The only way to keep those countries constantly supplied with dollars is for Americans to buy tons of foreign imports, which effectively sends dollars to those countries, since these purchases are made with dollars. If the countries instead bought a ton of US exports, they would be paying for those exports with dollars, which means all the dollars would be sent back to the US, and global nations would have a severe lack of US dollars. What would happen then? They would have no choice but to trade with their own currencies, which would mean the collapse of the dollar reserve system.

A simpler example: if a French person buys a $50,000 Ford truck and imports it to France, that’s $50,000 USD that leaves France and goes back to the US, lowering France’s dollar holdings. If an American buys a $50,000 French Peugeot to import it to the US, he sends his $50,000 USD to France, which increases its dollar holdings.

As seen, the only way to maintain the dollar’s reserve status is to make sure US dollars are constantly flooding the world, which can only be done by running a massive trade deficit where imports of foreign goods (outflow of USD) far outweigh exports of domestic goods (inflow of USD).

This contextualizes the Miran paper’s focus on the ‘overvaluation of the dollar’, particularly from the aspect of national security. Miran rightly notes that US national security is degraded in the current circumstances, by the erosion of manufacturing potential which leaves the US incapable of producing its defense imperatives. Miran’s thesis further provides for the tariffs being a tool not merely as some quick-and-cheap form of ‘revenue’, as some assume, but for the purpose of favorably rebalancing global currency valuations.

Tariffs as a Lever: Tariffs are a primary tool to address trade imbalances, not just for revenue but to force currency adjustments and protect domestic industries.

And the above does not mean Trump’s latest move intends to bring an end to the dollar reserve system. On the contrary, he intends to continue it in a more ‘fair’ manner. From the paper:

Despite the dollar’s role in weighing heavily on the U.S. manufacturing sector, President Trump has emphasized the value he places on its status as the global reserve currency, and threatened to punish countries that move away from the dollar. I expect this tension to be resolved by policies that aim to preserve the status of the dollar, but improve burden sharing with our trading partners.

For the crowd which crows that tariffs hurt the American consumer, who is forced to bear the burden of the costs, the paper outlines how that may not be the case:

In essence, the devaluation of foreign currency can offset the duties on imports. You’ll note this appears to contradict the premise of devaluing the dollar as well, but that’s where it gets much trickier. As I understand it, the paper proposes to strike a fine balance, explaining that if adversarial countries choose to devalue their currencies as a reaction—to boost their own exports—the pain could be ‘offset’ by the explanation above. Friendly countries, on the other hand, could agree to help devalue the dollar in what Miran imagines as a ‘Mar-a-Lago Accords’ agreement, akin to the Plaza Accords, or even the Bretton Woods agreement.

Miran also envisions the tariffs as just the first stage of a more elaborate operation. The tariffs could be used merely as the initial bullwhip to bring countries into negotiations, wherein Trump will then switch to a carrot-on-stick approach in alleviating or removing tariffs on countries which agree to finance ‘significant industrial investments’ into the US manufacturing sector.

Because of this, different stages of the process are expected, like the dollar first strengthening, then eventually weakening:

In any case, because President Trump has shown tariffs are a means by which he can successfully extract negotiating leverage—and revenue—from trading partners, it is quite likely that tariffs are used prior to any currency tools. Because tariffs are USD-positive, it will be important for investors to understand the sequencing of reforms to the international trading system. The dollar is likely to strengthen before it reverses, if it does so.

Miran does note the dangers, however:

Fourth, these policies may supercharge efforts of those looking to minimize exposure to the United States. Efforts to find alternatives to the dollar and dollar assets will intensify. There remain significant structural challenges with internationalizing the renminbi or inventing any sort of “BRICS currency,” so any such efforts will likely continue to fail, but alternative reserve assets like gold or cryptocurrencies will likely benefit.

Now the main argument revolves around whether US has a manufacturing backbone to even revive anymore. Many argue that at this point, things are ‘too far gone’—infrastructure has crumbled for too many decades, entire generations have lost the knowledge to build things, and perhaps worst of all, the culture in America has dwindled to become a kind of poisoned well that has disincentivized the newest generation of men from taking the types of jobs that would lead to some imagined manufacturing boom or golden age.

As one thread propounds:

In 1973 the US produced 111.4 million tons of steel. It employed 650,000 people. The industry now employs 142,000 and the US produces 79.5 million tons - which admittedly is better than the nadir of only 60 million tons under Reagan

Figures I’ve seen suggest there are now nearly 5 million less workers in the manufacturing sector than there were in the year 2000, despite the fact the US population has grown by a whopping 60 million people since then.

In many ways, what Trump is attempting to do is strongarm the world into a modern form of imperial neo-feudalism, where vassal states pay handsomely for the privilege of lowering their ‘protection’ racket fees. Some will argue this is an equitable system; in Anglo terms, perhaps. China envisions quite a different global order, without the need for mafia threats and coercion.

Also important to note is that Trump’s multi-phase plan includes the gradual replacement of the IRS with the ERS—or External Revenue Service. Trump’s Secretary of Commerce Howard Lutnik said as much many times, with increasing emphasis most recently; listen to the two clips below:

Trump makes a bit of a mistake in the end of his statement above—he claims tariffs would have saved us from the Great Depression, omitting that the infamous Smoot-Hawley tariffs in fact desperately tried, and arguably made things worse. He corrects himself, but says by then it was “too late” to act—a damning appraisal just as easily levied on his own nascent attempts to intervene at the Empire’s terminal arc.

A ‘fact check’ claimed it would be materially impossible to replace tax revenues with tariffs: