Bud, can I just say...you need to keep this secret knowledge and stop sharing it with the rest of the folks reading this....if others want to argue they're smarter, let them. I say, let them pay the taxes for you to continue to support the gov't spending programsSays the guy who brags about 'math' but yet unable to argue his point with math. In face, and this is the result of all your learning from youtube, you're completely unable to back up your statements. The best you can do is appeal to authority to some guy who just wants to sell his services.

Here is your original statment

"but ya I get it if you're retired and just want something steady with dividends but even then it's still suboptimal purely from a financial (not psychological) perspective"

Tell you what, here is some math for you since the context is retirement income and you think it's "suboptimal".

$80K income in Ontario, how do you want it?

Lets do two very realistic scenarios..a mix of income that takes advantage of the Dividend Tax Credit.

$40K in Income (RIF/Annuity/CPP) + $40K in Capital Gains in a taxable account = 12.23% Tax Rate

$40K in Income (RIF/Annuity/CPP) + $40K in Canadian Dividends in a taxable account= 8.34% Tax Rate (that's almost a 4% difference btw)

I'm not sure that you can see it but up to a certain income level, taxes on Dividend Income is significantly less than Income from Capital Gains or from Income like RIFs or Annuities. That means, you get to keep more of your money. You know that right?

Go ahead and steer people wrong because you love some guy's youtube video's.

Oh please, oh please, oh please show me how you're SUCH a master at math and how Dividends are irrelevant, and as you say, "suboptimal"?

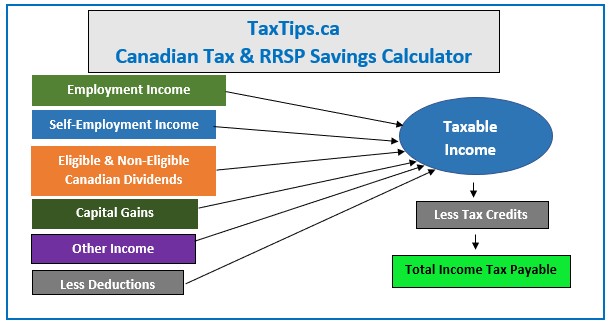

TaxTips.ca - 2025 and 2026 Canadian Tax Calculator

TaxTips.ca - 2025 and 2026 Canadian income tax and RRSP savings calculator - excellent tax planning tool - calculates taxes, shows RRSP savings, includes most deductions and tax credits.www.taxtips.ca

BCE

- Thread starter Carvher

- Start date

please, stop, and i hope you're not a financial advisor / give people retirement advice; you don't look at the whole picture.Says the guy who brags about 'math' but yet unable to argue his point with math. In face, and this is the result of all your learning from youtube, you're completely unable to back up your statements. The best you can do is appeal to authority to some guy who just wants to sell his services.

Here is your original statment

"but ya I get it if you're retired and just want something steady with dividends but even then it's still suboptimal purely from a financial (not psychological) perspective"

Tell you what, here is some math for you since the context is retirement income and you think it's "suboptimal".

$80K income in Ontario, how do you want it?

Lets do two very realistic scenarios..a mix of income that takes advantage of the Dividend Tax Credit.

$40K in Income (RIF/Annuity/CPP) + $40K in Capital Gains in a taxable account = 12.23% Tax Rate

$40K in Income (RIF/Annuity/CPP) + $40K in Canadian Dividends in a taxable account= 8.34% Tax Rate (that's almost a 4% difference btw)

I'm not sure that you can see it but up to a certain income level, taxes on Dividend Income is significantly less than Income from Capital Gains or from Income like RIFs or Annuities. That means, you get to keep more of your money. You know that right?

Go ahead and steer people wrong because you love some guy's youtube video's.

Oh please, oh please, oh please show me how you're SUCH a master at math and how Dividends are irrelevant, and as you say, "suboptimal"?

TaxTips.ca - 2025 and 2026 Canadian Tax Calculator

TaxTips.ca - 2025 and 2026 Canadian income tax and RRSP savings calculator - excellent tax planning tool - calculates taxes, shows RRSP savings, includes most deductions and tax credits.www.taxtips.ca

i should just have just stopped responding when you said you cant spend total returns.

or....let the gov't take away from you in other discreet ways if you take advice from him.Bud, can I just say...you need to keep this secret knowledge and stop sharing it with the rest of the folks reading this....if others want to argue they're smarter, let them. I say, let them pay the taxes for you to continue to support the gov't spending programs

not that im near that age, anyway.

I'm not gonna fucking write out several paragraphs and do calculations of various scenarios for free. Only did a google search so that others can see the various retirement strategies and not fall for canned, cookie-cutter approaches.I get it, you’re a blowhard who talks big but crumbles & melts when confronted. It must suck to be you.

And, even though there is a scenario where CANADIAN dividends CAN minimize tax within an income RANGE, you're limiting your opportunity set, thereby limiting your return AND diversification, the counter of the holy grail of investing.

The 6 best strategies to minimize tax on your retirement income

If you had a salary all your life, you may have had limited tax deductions or tax saving strategies. When you retire, it is completely different.

Self-Made Dividends – Dividend Investing Perfected – Ed Rempel

Dividend or income investors, here are the fundamental facts on how to save tax. Would you like to receive dividends of any amount you want from your non-registered investments, and pay less tax than on ordinary dividends? You can easily do this with a little planning and proper understanding of...

edrempel.com

edrempel.com

You're adding NEGATIVE value by spouting off crap.I'm not gonna fucking write out several paragraphs and do calculations of various scenarios for free.

hahahaha, "for free". Simple math is "free".It's clear you know nothing but what you've learned on Youtube as you have yet to provide one single example to back up what you said. You add zero value to the discussion. You're just not capable, I get it. Don't feel bad.

Only did a google search so that others can see the various retirement strategies and not fall for canned, cookie-cutter approaches.

No shit Sherlock, I never made that claim of 'cookie cutter' approaches. Yet you did with your "sub-optimal" comment inferring that, if you want retirement income, there is a better way, your way. By the way, you provided only one point of view instead of "various retirement strategies" with your "google learning". Nice try though.

And, even though there is a scenario where CANADIAN dividends CAN minimize tax within an income RANGE, you're limiting your opportunity set, thereby limiting your return AND diversification, the counter of the holy grail of investing.

Holy Shit, you actually provided an example, "diversification". Way to go! You must be so proud of yourself.

Yet, here is the thing. You’re not seeing the big picture, Divided income is only good for taxable accounts. You diversify in your RRSP & TFSA accounts for, given there is no DTC, dividend income is “non-existent”. It’s either income or tax-free. You need to start thinking about the whole thing across all accounts.

By the way, that scenario for the income RANGE you're referring to is a quite large one given the amount of people are able to save for retirement. This covers the majority of people. As it's clear you don't know any details, the tax rate for Dividends is below that of Capital Gains up to around $100K (2024/ON). $100K income is roughly more than $2.5M+ in investments....VERY Few have that levels saved AND very few have 100% dividends or 100% capitals making the utility of Dividend Income for retirement that much better. Obviously it's always a mix of LIF/RIF/CPP & TFSA in addition to taxable accounts. Thus, this makes dividends for retirement income - which IS the subject - that much higher. Not really 'sub-optimal' as you say. Too bad you're so focussed on Youtube videos you miss this.

But thanks for acknowledging I am correct with my assessment.

Ya..you end with more references because you're completely unable to argue for yourself. Best you can do is throw stones. What's the phrase? Right, "All hat and no cattle".

It is not MY way; it's objective MATH--you're just sour because it goes against what YOU think is the best way.

Dividends are only good for taxable account? Within a specific RANGE, but as mentioned, at the expense of diversification AND RETURN (you conveniently left that out)--at the end of the day, it's about maximizing your after-tax RETURN.

I'm not seeing the big picture? LOL, yet you're talking about limiting your opportunity set to only CANADIAN dividend-paying stocks and you're not factoring clawbacks since income-tested benefits are based NET INCOME and Canadian dividends are GROSSED UP and those figures are included in net income.

Stick with your Canadian dividends, have fun.

You thought I was talking about diversification in terms of accounts, I'm talking about investments, you retard.It is not MY way; it's objective MATH--you're just sour because it goes against what YOU think is the best way.

You talk of "math" and have yet to show any. Huh. Those who know, know why you don't.

Dividends are only good for taxable account? Within a specific RANGE, but as mentioned, at the expense of diversification AND RETURN (you conveniently left that out)--at the end of the day, it's about maximizing your after-tax RETURN.

..and weird how the DTC is only available in a taxable account and thus only applicable in a taxable accounts.

As for the diversification, the taxable account is only one of many accounts. I've no idea why you think it's the only account one invests in. You can easily diversify away from the typical high-yield financials/resources that the taxable account invests in for an overall more balanced portfolio. A standard approach is bonds (for that 60/40 mix that people seem to love) in the RRSP since everything is income when withdrawn anyway.

As for after-tax return, duh, I pretty much showed how it happens and how after-tax dividend income is superior to capital gains and, of course, income. It also happens over a very, very wide retirement income range as I've illustrated. What you have shown? Zippo. All hat. As for "returns", this is always the standard hand-waving response that you 'bros make. You cannot promise future returns yet you seem to think you can with this argument.

By the way, personal experience, my dividend income has grown 7.6% a year (simple compounded) over the last 10 years. Not a bad annual raise. My investing return (Time Weighted Rate of Return Method) in my taxable account is 10.59% v. TSX 9.09% over the same time period. "Returns". Uh huh. Blah blah blah, you do better...doubt it. I really do. Your "returns" argument is dumb. Do better

I'm not seeing the big picture? LOL, yet you're talking about limiting your opportunity set to only CANADIAN dividend-paying stocks and you're not factoring claw backs since income-tested benefits are based NET INCOME and Canadian dividends are GROSSED UP and those figures are included in net income.

So, you obviously don't know this but the Dividend Tax Credit that you can use to reduce your tax liability on other sources of income is only available with Canadian Dividend-paying stocks. This is basic stuff. Again, the taxable account is only one of many accounts. I've no idea why you think it's the only account one invests in. In addition to income-investments, you would obviously invest in US stocks (say VOO, whatever) in your RRSP to avoid the resulting US taxes that hit you in the TFSA. You've filled out your W-8BEN right? The TFSA is a great long-term investing account and thus provides even more diversification using other investing strategies. However, you are limited in the amount, much like the RESP, you can invest in. Generally, your TFSA should be in the $100K to $200K range** right now which isn't a lot for retirement. You seem to infer you're some sort of financial planner and thus, this is all very, very basic stuff, why don't you know this?

As for income-tested benefits, if you did the spreadsheet on it, you'd see the very clear/obvious/very quick benefits of having more income. The cross over point happens very quickly. Remaining poor on income-tested benefits is not a good long term goal. Getting claw backs is a good thing because it means you have too much $ right? Damn, too much money. Again, this is very basic stuff and I'm uncertain why you think "Muh OAS" it's a cogent argument. You're just spouting FUD that the ignorant fall for.

** Then again, in 2020, apparently only 8.9% of TFSA holders maximized contributions to their TFSAs

Let's step back and look at your arguments:

1) you said you can't spend "total returns"--false, and looks like you're admitting that now, LOL.

2) dividends are more tax efficient to a certain level--false. within a certain RANGE (~25k to 45k), but at the EXPENSE of investment diversification and almost certainly ROI over the long run. Even with the TAX CREDIT, they're terribly tax inefficient, particularly at higher income levels.

" By the way, personal experience, my dividend income has grown 7.6% a year (simple compounded) over the last 10 years. Not a bad annual raise. My investing return (Time Weighted Rate of Return Method) in my taxable account is 10.59% v. TSX 9.09% over the same time period. "Returns". Uh huh. Blah blah blah, you do better...doubt it. I really do. Your "returns" argument is dumb. Do better

LOL, looking at the big picture and you're restricting yourself to Canadian equities (I get it, home bias) and thinking your portfolio has outperformed other indices.

As for income-tested benefits, if you did the spreadsheet on it, you'd see the very clear/obvious/very quick benefits of having more income. The cross over point happens very quickly. Remaining poor on income-tested benefits is not a good long term goal. Getting claw backs is a good thing because it means you have too much $ right? Damn, too much money. Again, this is very basic stuff and I'm uncertain why you think "Muh OAS" it's a cogent argument. You're just spouting FUD that the ignorant fall for."

First, there's more to just OAS. Spouting FUD? Oh , lord, the whole point is to minimize what the gov't takes away from you (taxes and benefits, because a reduction in benefits is effectively an increase in tax)--it has nothing to do with "remaining poor."

if you can structure your portfolio cash flow to allow to get benefits and meet your desired total cash flow , why the hell wouldn't you ?

if you're cash flows needs are so high that it completely swamps the benefit thresholds, at that point capital gains are more tax efficient anyway.

And if you still don't get it, then you're hopeless.

Last edited:

I just want to say, that it's clear the your counter-part in this forum isn't a financial advisor/planner.You thought I was talking about diversification in terms of accounts, I'm talking about investments, you retard.

You diversify ACROSS the investment accounts. It's obviously clear that you're just focussed on dividends in taxable accounts and insulting me won't change the fact that you are in error.

So, for example. You have X% in financials & resources in your taxable account, you have X% in US/International in your RRSP with X% in Bonds/GIC and then X% of a balance in your TFSA in order to diversify. This is basic stuff. Why are you missing this?

Let's step back and look at your arguments:

1) you said you can't spend "total returns"--false, and looks like you're admitting that now, LOL.

The standard bullshit response of the anti-dividend folks like you is "bruh, total returns". That's so dumb because the reason you invest is for income and you need to be aware of the consequences of converting the investment to income. This is something you've clearly ignored. Tell you want, prove to me that your future returns on non-dividend investing than standard dividend investing. God I hope you respond to this basic trap of making you predict future stock returns

2) dividends are more tax efficient to a certain level--false. within a certain RANGE (~25k to 45k), but at the EXPENSE of investment diversification and almost certainly ROI over the long run. Even with the TAX CREDIT, they're terribly tax inefficient, particularly at higher income levels.

Uhhh...No. They are more tax efficient and this REALLY depends on other income to use the DTC against, up to $125K-ish. It's obvious you have done the spreadsheet on this. This is compared to capital gains where you don't get any sort of tax credit but more efficient taxation than straight income naturally.

I've also shown you how, at the $80K income level, dividends are more tax efficient than capital gains yet you state they're only good at $45K? Really?

You must have some awesome math there. Let me repeat. Feeling obviously dumb for forgetting about this?

$80K income in Ontario, how do you want it?

Lets do two very realistic scenarios. A mix of income that takes advantage of the Dividend Tax Credit.

$40K in Income (RIF/Annuity/CPP) + $40K in Capital Gains in a taxable account = 12.23% Tax Rate

$40K in Income (RIF/Annuity/CPP) + $40K in Canadian Dividends in a taxable account= 8.34% Tax Rate (that's almost a 4% difference btw)

www.taxtips.ca << you should really use this

" By the way, personal experience, my dividend income has grown 7.6% a year (simple compounded) over the last 10 years. Not a bad annual raise. My investing return (Time Weighted Rate of Return Method) in my taxable account is 10.59% v. TSX 9.09% over the same time period. "Returns". Uh huh. Blah blah blah, you do better...doubt it. I really do. Your "returns" argument is dumb. Do better"

LOL, looking at the big picture and you're restricting yourself to Canadian equities (I get it, home bias) and thinking your portfolio has outperformed other indices.

I've only compared it to the TSX because it's investing in Canadian equities. You think I should compare it do the DAX or something? You use those made up bench marks that financial planners use? Really? Don't be silly. Your comment is literally dumb. Unless you think you should compare apples to oranges? In addition, it sounds like you're one of these 'bros that think they can get double-digit returns forever. Trust me, a 7.6% RoR (on just income) is far better than most. In addition, the 11% is really better than most.

Per SPIVA, 96.63% of funds underperformed the S&P/TSX Composite over 10 years. Huh

As for income-tested benefits, if you did the spreadsheet on it, you'd see the very clear/obvious/very quick benefits of having more income. The cross over point happens very quickly. Remaining poor on income-tested benefits is not a good long term goal. Getting claw backs is a good thing because it means you have too much $ right? Damn, too much money. Again, this is very basic stuff and I'm uncertain why you think "Muh OAS" it's a cogent argument. You're just spouting FUD that the ignorant fall for."

First, there's more to just OAS. Spouting FUD? Oh , lord, the whole point is to minimize what the gov't takes away from you (taxes and benefits, because a reduction in benefits is effectively an increase in tax)--it has nothing to do with "remaining poor."

if you can structure your portfolio cash flow to allow to get benefits and meet your desired total cash flow , why the hell wouldn't you ?

if you're cash flows needs are so high that it completely swamps the benefit thresholds, at that point capital gains are more tax efficient anyway.

OAS is $9K per year (65 to 74). You're going to "structure your cash flow" so you get to keep the $9K per year that barely grows at inflation versus investments that grow at, say, 5% a year? Really?

PLEASE FEEL FREE TO PROVIDE ONE SINGLE EXAMPLE TO BACK UP YOUR BULLSHIT. I have yet to see one. So far, still all Hat.

Dear god, I hope you're really not a financial 'planner". OAS recovery starts at $81,761 and max recovery is at $134,626. You ARE spouting FUD. Hahahaha, how many Canadians are going to have to worry about income recovery at that level? In addition, your argument ignores the 35% DTC non-refundable tax credit that you're applying against other income when recovery begins. This is why it's only a problem for a few years then the true benefits become clear. Do the actual math and don't take things at face value.

So, Dividends are more tax efficient than capital gains (2024 & ON) up to $106K and on a marginal tax basis, it's around $135K ish or so (depending) is my guess. You say it starts $25K Really? Why? Do you know so little about tax rates that you think that?

I'm honestly surprised you haven't responded with the really obvious - and correct - arguments against investing for dividends. You're really new to this aren't you?

As for your statement, " minimize what the gov't takes away from you", I repeat....

$40K in Income (RIF/Annuity/CPP) + $40K in Capital Gains in a taxable account = 12.23% Tax Rate

$40K in Income (RIF/Annuity/CPP) + $40K in Canadian Dividends in a taxable account= 8.34% Tax Rate (that's almost a 4% difference btw)

That said, it's well known in the Canadian Financial system that Canadian Dividends are generally more tax-efficient in a non-reg account. That said, buying/investing in other equities outside of Canada, there's no real way to shelter the with-holding tax, for example in the U.S.

Overall, you both aren't entirely wrong in your viewpoints. It's more so a matter of what the goal is and which perspective. You both have cited the right information for many folks to benefit from

Use the RRSP or RRIF if you want to completely avoid U.S. withholding tax. But it must be an American ETF invested in U.S. stocks or just a U.S. stock bought directly.I just want to say, that it's clear the your counter-part in this forum isn't a financial advisor/planner.

That said, it's well known in the Canadian Financial system that Canadian Dividends are generally more tax-efficient in a non-reg account. That said, buying/investing in other equities outside of Canada, there's no real way to shelter the with-holding tax, for example in the U.S.

Overall, you both aren't entirely wrong in your viewpoints. It's more so a matter of what the goal is and which perspective. You both have cited the right information for many folks to benefit from.

It will not work if you buy a Canadian ETF invested in U.S. stocks.

Also, I believe Canadians pay no withholding tax on U.K. dividends.

U.S. withholding tax in an RRSP for Canadians - MoneySense

For Canadians who have withholding tax on U.S. income in an RRSP, sometimes this tax can be avoided.

TaxTips.ca - Investments Inside vs Outside RRSPs

TaxTips.ca - Which investments should be held inside an RRSP, and which ones should be held in a non-registered account?

Last edited:

You thought I was talking about diversification in terms of accounts, I'm talking about investments, you retard.

You diversify ACROSS the investment accounts. It's obviously clear that you're just focussed on dividends in taxable accounts and insulting me won't change the fact that you are in error.

So, for example. You have X% in financials & resources in your taxable account, you have X% in US/International in your RRSP with X% in Bonds/GIC and then X% of a balance in your TFSA in order to diversify. This is basic stuff. Why are you missing this?

No shit about using both your RRSP and TFSA; I'm focusing on taxable account because that what the fuck arguing about. This is a classic tactic to try to divert the topic--it started off by saying you can't spend "total returns" and dividends are the most tax efficient to a "certain level."

The standard bullshit response of the anti-dividend folks like you is "bruh, total returns". That's so dumb because the reason you invest is for income and you need to be aware of the consequences of converting the investment to income. This is something you've clearly ignored. Tell you want, prove to me that your future returns on non-dividend investing than standard dividend investing. God I hope you respond to this basic trap of making you predict future stock returns

You don't believe in math; you view $100 from dividends as different from $100 from selling shares. What you're referring to is the PSYCHOLOGICAL / BEHAVIOURAL component (which I mentioned in my first post); and speaking of CONSEQUENCES, one needs to be cognizant of the consequences of receiving "forced" dividends (and thus forced taxes) in a non-registered account.

2) dividends are more tax efficient to a certain level--false. within a certain RANGE (~25k to 45k), but at the EXPENSE of investment diversification and almost certainly ROI over the long run. Even with the TAX CREDIT, they're terribly tax inefficient, particularly at higher income levels.

Uhhh...No. They are more tax efficient and this REALLY depends on other income to use the DTC against, up to $125K-ish. It's obvious you have done the spreadsheet on this. This is compared to capital gains where you don't get any sort of tax credit but more efficient taxation than straight income naturally.

I've also shown you how, at the $80K income level, dividends are more tax efficient than capital gains yet you state they're only good at $45K? Really?

You must have some awesome math there. Let me repeat. Feeling obviously dumb for forgetting about this?

$80K income in Ontario, how do you want it?

Lets do two very realistic scenarios. A mix of income that takes advantage of the Dividend Tax Credit.

$40K in Income (RIF/Annuity/CPP) + $40K in Capital Gains in a taxable account = 12.23% Tax Rate

$40K in Income (RIF/Annuity/CPP) + $40K in Canadian Dividends in a taxable account= 8.34% Tax Rate (that's almost a 4% difference btw)

www.taxtips.ca << you should really use this

Taxtips.ca does NOT factor in the claw backs (which increases your effective tax rate) and deferred taxes from capital gains, dimwit. E.g., let's say your cost base is $100K and your investment quadruples to $400k (to use extremes). You want $20K a year additional income from your investments; so your capital gain is $15K, but only $7.5K is taxable. That is almost definitely better than receiving $20K in dividends.

" By the way, personal experience, my dividend income has grown 7.6% a year (simple compounded) over the last 10 years. Not a bad annual raise. My investing return (Time Weighted Rate of Return Method) in my taxable account is 10.59% v. TSX 9.09% over the same time period. "Returns". Uh huh. Blah blah blah, you do better...doubt it. I really do. Your "returns" argument is dumb. Do better"

LOL, looking at the big picture and you're restricting yourself to Canadian equities (I get it, home bias) and thinking your portfolio has outperformed other indices.

I've only compared it to the TSX because it's investing in Canadian equities. You think I should compare it do the DAX or something? You use those made up bench marks that financial planners use? Really? Don't be silly. Your comment is literally dumb. Unless you think you should compare apples to oranges? In addition, it sounds like you're one of these 'bros that think they can get double-digit returns forever. Trust me, a 7.6% RoR (on just income) is far better than most. In addition, the 11% is really better than most.

Your reading comprehension is bad. I first mentioned talking about the big picture and then you use the same words against me regarding another point. So, let's talk about the big picture, which is the world of equities, where Canadian equities represent peanuts in terms global equities.

But, let's ignore that for a second--so now you're essentially saying you have superior stock selection skills by choosing Canadian dividend-paying stocks and are able to outperform the market on a risk-adjusted basis (in this case, Canadian indices, including Canadian dividend indices), and believe you can continue in the foreseeable future. hahaha, gotcha!

"Per SPIVA, 96.63% of funds underperformed the S&P/TSX Composite over 10 years." ? LOL, why are you quoting this pretty well-known stat? Because you're trying to prove you're the outlier?

OAS is $9K per year (65 to 74). You're going to "structure your cash flow" so you get to keep the $9K per year that barely grows at inflation versus investments that grow at, say, 5% a year? Really?

PLEASE FEEL FREE TO PROVIDE ONE SINGLE EXAMPLE TO BACK UP YOUR BULLSHIT. I have yet to see one. So far, still all Hat.

Dear god, I hope you're really not a financial 'planner". OAS recovery starts at $81,761 and max recovery is at $134,626. You ARE spouting FUD. Hahahaha, how many Canadians are going to have to worry about income recovery at that level? In addition, your argument ignores the 35% DTC non-refundable tax credit that you're applying against other income when recovery begins. This is why it's only a problem for a few years then the true benefits become clear. Do the actual math and don't take things at face value.

So, Dividends are more tax efficient than capital gains (2024 & ON) up to $106K and on a marginal tax basis, it's around $135K ish or so (depending) is my guess. You say it starts $25K Really? Why? Do you know so little about tax rates that you think that?

I'm honestly surprised you haven't responded with the really obvious - and correct - arguments against investing for dividends. You're really new to this aren't you?

Oh, lord, LOL, so now you're argument is basically now, "Oh, who cares about paying back OAS (or other benefit )even if I dont need to! I'm just a baller anyway!" The point is NOT having to pay it back/losing IF YOU DON'T need to (again, the goal is to minimize what the gov't takes from you). If I can get the gov't to give me essentially 10K a year (oas) for several years (even if it's a year or intermittent) without having to dip into my portfolio, you damn right I'm gonna take that (did you conveniently forget the power of compounding?).

Last edited:

Well, if youre trying to minimize what the govt' takes away from you (taxes , benefits/clawbacks), capitals gains, not dividends, will give you much more control of that.I just want to say, that it's clear the your counter-part in this forum isn't a financial advisor/planner.

That said, it's well known in the Canadian Financial system that Canadian Dividends are generally more tax-efficient in a non-reg account. That said, buying/investing in other equities outside of Canada, there's no real way to shelter the with-holding tax, for example in the U.S.

Overall, you both aren't entirely wrong in your viewpoints. It's more so a matter of what the goal is and which perspective. You both have cited the right information for many folks to benefit from.

Generally more tax efficient in a non-reg account? Well, I'd argue those who are able to max out their registered accounts AND are able to put a sizable amount into a non-reg account are making a high level if income to which the benefits of the DTC are washed away.

Last edited:

Sprite..how did you arrive to "a high-income earner would have the DTC washed away, provided they are maxed in their registered accounts? That's not how DTC mechanics work!Well, if youre trying to minimize what the govt' takes away from you (taxes , benefits/clawbacks), capitals gains, not dividends, will give you much more control of that.

Generally more tax efficient in a non-reg account? Well, I'd argue those who are able to max out their registered accounts AND are able to put a sizable amount into a non-reg account are making a high level if income to which the benefits of the DTC are washed away.

Those that are earning Dividends in registered accounts, will not have any dividends taxed and the DTC be applied. It's a straight non-taxable event. In a non-registered event, as you know, the gross up method and the DTC are designed so that individuals aren't paying double tax on corporate profits, which are later distributed to shareholders. The DTC is not an income-tested credit.

If you make these statements, help us understand your POV of how you arrived to that position. Otherwise, it's an opinion with no merit.

I'll be honest...I'll probably won't read any response following this post as it's diverted from the original topic about BCE and no benefit in educating other members lol.

Sprite..how did you arrive to "a high-income earner would have the DTC washed away, provided they are maxed in their registered accounts? That's not how DTC mechanics work!

Those that are earning Dividends in registered accounts, will not have any dividends taxed and the DTC be applied. It's a straight non-taxable event. In a non-registered event, as you know, the gross up method and the DTC are designed so that individuals aren't paying double tax on corporate profits, which are later distributed to shareholders. The DTC is not an income-tested credit.

If you make these statements, help us understand your POV of how you arrived to that position. Otherwise, it's an opinion with no merit.

I'll be honest...I'll probably won't read any response following this post as it's diverted from the original topic about BCE and no benefit in educating other members lol.

I said those who max out their registered accounts and put a sizable amount in their NON-registered accounts! Yes, I'm NOT talking about DTC for REGISTERED accounts for obvious reasons.

The benefits of DTC are diminished the higher your salary/income level; and back to my point, if you're able to MAX out your REGISTERED accounts, AND area able to put money into a NON-REGISTERED account and buy Canadian dividends in that NON-registered account because you believe they're tax efficient, the you're, on the balance of probability, at a very high income / salary high where the DTC washes away and capital gains are actually more tax efficient.

Last edited:

Finailly, you've explicity mentioned "control" over income. That is one of the real drawbacks of Dividend investing. As one approaches the $100K level of dividend income, the benefits of "oh, I should have done Capital Gains" becomes more & more obvious. However, (a) it's a problem few will have, (b) too much $ is always a good thing.

"benefits of the DTC are washed away" - Then again, don't forget, RRSP/RIF/LIF/Annuities withdrawals are taxed as income, the highest level. In addition, there is the TFSA which could be providing, say using SWR of 4%, $8K to $10K per year and more inthe upcoming years. Thus, if you optimize your taxable account to best offset the RRSP/RIF withdrawals, you can provide the best tax optimized strategy. It's easy enough to simulate where the cross over point is once you have a good idea what the income level is.

You're thinking ONLY capital gains versus Dividends. You're not taking into account the "3rd leg" of income (RIF/LIF/CPP/etc) that can be reduced with the DTC. This is one of the flaws in the "Dividends are bad" arguement that isn't typically taken in to consideration. It's not either or, it's optimization to reduce the amount of "Income" that is taxed.

For those not making a high level of income, say $60K to $90K), it's then the RRSP versus TFSA argument that becomes more important than CG v. Dividends.

1) to those who didn't know, now you know.

2) yes, that is correct within a range, and in fact with the DTC it's a negative tax within this range (ie govt pays you). to which I'll counter; it comes back to flexibility...

one does not need to restrict himself to Canadian-dividend paying stocks; Canadian stocks only are only a small percentage of global equities to begin with (3 percent as I'm sure you aware ) and sticking to only Canadian dividend-paying stocks reduces that even further. thus, one needs to be aware of the sacrifice of diversification and potential returns.

but, again, some people are comfortable and like buying domestic equities (familiarlity/home bias) and "seeing" dividends coming into their account (mental accounting bias). and, i understand, some people are uncomfortable selling their shares to create a "homemad dividend" (for those who don't know, that's the term used in academic literature)...eg my friend has an emotional attachment to a big bank's shares that he "earned " through many years of service .

these behavioural biases can be triumphed via education, but i understand not always. finance is often more behavioural than rational.

TFSa vs RRSP ...diverging here, but in a nutshell for others, if one thinks his tax rate in retirement will be lower than your current tax rate, then you contribute to your RRSP. thus, likely makes sense if you're in the upper tax brackets and makes zero sense if you're in the lowest tax bracket

Enjoy your long Weekend ,everyone.

You need to prove out what you're stating. Cause your statements are contradictory....I said those who max out their registered accounts and put a sizable amount in their NON-registered accounts! Yes, I'm NOT talking about DTC for REGISTERED accounts for obvious reasons.

The benefits of DTC are diminished the higher your salary/income level; and back to my point, if you're able to MAX out your REGISTERED accounts, AND area able to put money into a NON-REGISTERED account and buy Canadian dividends in that NON-registered account because you believe they're tax efficient, the you're, on the balance of probability, at a very high income / salary high where the DTC washes away and capital gains are actually more tax efficient.

What is contradictory? If you're making well over 100k a year, you're better off paying capital gains vs getting Canadian dividends w/ DTC.You need to prove out what you're stating. Cause your statements are contradictory....

Sounds like you don't know how the taxes work lol. You're just making claims/statements. Good to know that this discussion isn't going anywhere.What is contradictory? If you're making well over 100k a year, you're better off paying capital gains vs getting Canadian dividends w/ DTC.

Where is the bottomSounds like you don't know how the taxes work lol. You're just making claims/statements. Good to know that this discussion isn't going anywhere.

I said on earlier post that I thought it would be 44. It just hit that. Am I buying more? Fuck no.Where is the bottom

But if I didn't own any, I would be watching it very closely now because this is a great entry point.