What is your annual income?

- Thread starter 33333

- Start date

LOL. sure palSerious responses only.

Interesting to see the results. It's an expensive and addictive hobby. I started hobbying regularly when I thought I had 'made it' (making 80k per year - back in 2000!)

You know that EVERY SINGLE PERSON WHO VOTED IS OBVIOUSLY TELLING THE TRUTH!!LOL. sure pal

Income is less than $15,000/year, just doing part time instacart and some income from dividends. But no debts, car and house are paid off. I simply sell stock when I need money.

It's possibe to have zero income, but be extremely wealthy and live off hundreds of thousands of dollars a year.

From what I understand, the rich borrow against their assets (such as a reverse mortgage for their house, or they borrow against their investments (e.g https://www.td.com/ca/en/personal-b...s-of-credit/investment-secured-line-of-credit).

Since this borrowed money has a lower interest at than what you would expect from your investments, you come out ahead. If you were to pull that money out from your rrsp or nonregistered investment account, you would pay about 25-30% in taxes. But since you are borrowing money, you pay zero taxes.

Example:

I have $500,000 in stocks. I borrow $100,000 using the investment as collateral, to pay for a lavish vacation and living expenses for a year. I have to pay 6% interest, so I pay $106,000 after one year.

Meanwhile after one year, that $100,000 that I did not take out would have earned me more than the 6% by keeping it in the investment account. So it ends up being a free loan.

However, if I had taken that money out of my rrsp, I would have had to pay $20,000 in taxes.

This is what Elon Musk and the other billionaires do all the time, and never pay income tax. They have very little income, but tons of assets to borrow against.

It's possibe to have zero income, but be extremely wealthy and live off hundreds of thousands of dollars a year.

From what I understand, the rich borrow against their assets (such as a reverse mortgage for their house, or they borrow against their investments (e.g https://www.td.com/ca/en/personal-b...s-of-credit/investment-secured-line-of-credit).

Since this borrowed money has a lower interest at than what you would expect from your investments, you come out ahead. If you were to pull that money out from your rrsp or nonregistered investment account, you would pay about 25-30% in taxes. But since you are borrowing money, you pay zero taxes.

Example:

I have $500,000 in stocks. I borrow $100,000 using the investment as collateral, to pay for a lavish vacation and living expenses for a year. I have to pay 6% interest, so I pay $106,000 after one year.

Meanwhile after one year, that $100,000 that I did not take out would have earned me more than the 6% by keeping it in the investment account. So it ends up being a free loan.

However, if I had taken that money out of my rrsp, I would have had to pay $20,000 in taxes.

This is what Elon Musk and the other billionaires do all the time, and never pay income tax. They have very little income, but tons of assets to borrow against.

Last edited:

I identify as a retired general but the transphobes at the DoD refuse to pay out.Besides income, I would like a government worker's indexed pension and retirement health benefits and job security.

Not just a retired general but the very model of a retired modern major general.

This is incorrect.If you were to pull that money out from your rrsp or nonregistered investment account, you would pay about 25-30% in taxes.

Your tax rate depends on your total income and tax bracket when you file.

What you are probably referring to is withholding tax and even that is incorrect.

Witholding tax also depends on how much you are pulling out. Those also have brackets.

So it could be as low as 10% witholding tax or as high as 30%

Withholding tax is not necessarily the actual tax you pay.

I endorse your crusade.I identify as a retired general but the transphobes at the DoD refuse to pay out.

Not just a retired general but the very model of a retired modern major general.

You say by not withdrawing from your RRSP you do not have to pay taxes.Income is less than $15,000/year, just doing part time instacart and some income from dividends. But no debts, car and house are paid off. I simply sell stock when I need money.

It's possibe to have zero income, but be extremely wealthy and live off hundreds of thousands of dollars a year.

From what I understand, the rich borrow against their assets (such as a reverse mortgage for their house, or they borrow against their investments (e.g https://www.td.com/ca/en/personal-b...s-of-credit/investment-secured-line-of-credit).

Since this borrowed money has a lower interest at than what you would expect from your investments, you come out ahead. If you were to pull that money out from your rrsp or nonregistered investment account, you would pay about 25-30% in taxes. But since you are borrowing money, you pay zero taxes.

Example:

I have $500,000 in stocks. I borrow $100,000 using the investment as collateral, to pay for a lavish vacation and living expenses for a year. I have to pay 6% interest, so I pay $106,000 after one year.

Meanwhile after one year, that $100,000 that I did not take out would have earned me more than the 6% by keeping it in the investment account. So it ends up being a free loan.

However, if I had taken that money out of my rrsp, I would have had to pay $20,000 in taxes.

This is what Elon Musk and the other billionaires do all the time, and never pay income tax. They have very little income, but tons of assets to borrow against.

The truth of the matter is you are merely deferring paying taxes.

You will eventually have to pay taxes when you withdraw from your RRSP unless of course you plan never to withdraw from it but that would just lead to a lump sum tax of probably 50% upon death.

Wealthy individuals primarily generate their income through asset appreciation, rather than salaries or bonuses. Unlike ordinary income, taxes on asset appreciation are deferred until the asset is sold, resulting in a significant tax liability. To avoid or delay this tax obligation, the wealthy can leverage their wealth by borrowing against it, using the proceeds not only to cover expenses but also to invest in new ventures. This technique allows them to keep their tax bills low, continue to benefit from the appreciation of their invested assets, and increase their overall net worth with the additional investments made with the loan funds.Income is less than $15,000/year, just doing part time instacart and some income from dividends. But no debts, car and house are paid off. I simply sell stock when I need money.

It's possibe to have zero income, but be extremely wealthy and live off hundreds of thousands of dollars a year.

From what I understand, the rich borrow against their assets (such as a reverse mortgage for their house, or they borrow against their investments (e.g https://www.td.com/ca/en/personal-b...s-of-credit/investment-secured-line-of-credit).

Since this borrowed money has a lower interest at than what you would expect from your investments, you come out ahead. If you were to pull that money out from your rrsp or nonregistered investment account, you would pay about 25-30% in taxes. But since you are borrowing money, you pay zero taxes.

Example:

I have $500,000 in stocks. I borrow $100,000 using the investment as collateral, to pay for a lavish vacation and living expenses for a year. I have to pay 6% interest, so I pay $106,000 after one year.

Meanwhile after one year, that $100,000 that I did not take out would have earned me more than the 6% by keeping it in the investment account. So it ends up being a free loan.

However, if I had taken that money out of my rrsp, I would have had to pay $20,000 in taxes.

This is what Elon Musk and the other billionaires do all the time, and never pay income tax. They have very little income, but tons of assets to borrow against.

However, leveraging can also be beneficial for other individuals, such as homeowners who can borrow against their home equity or use leverage to pay for significant expenses, and affluent investors who can utilize similar borrowing strategies to preserve and grow their assets.

The minimum wage in Ontario is $16.55/hour as of now. The average working full time hours per year is 2,000 hour or 40 hours per week. SO that means a person is earning $33,100 per year.

If some one says I make 65k per year divide by 2 and that is their hourly income. Compared to the minimum wage.

In conclusion if you make/earn less than 40k you have to live with your parents or a lot of roommates. Unless you made money before or in investments to not worry about you salary.

I think the majority of people are less than 50K.

I met guys who live poor but had great adventures over seas and here, but now are 70 and living with other people in a house for an exchange of doing shores around the house. I can't see women doing this at all. Nor have I met women do this except for a few sister back in the 90's. I have seen women come back to Canada and marry old men or their age group only for the CPP because they never paid for it since living in the US or abroad. These women know some of the men from high school or they meet new ones.

If you can't save now and not think for the future, no income will help. I seen most people try to save but they can't because of some weird karma.

If some one says I make 65k per year divide by 2 and that is their hourly income. Compared to the minimum wage.

In conclusion if you make/earn less than 40k you have to live with your parents or a lot of roommates. Unless you made money before or in investments to not worry about you salary.

I think the majority of people are less than 50K.

I met guys who live poor but had great adventures over seas and here, but now are 70 and living with other people in a house for an exchange of doing shores around the house. I can't see women doing this at all. Nor have I met women do this except for a few sister back in the 90's. I have seen women come back to Canada and marry old men or their age group only for the CPP because they never paid for it since living in the US or abroad. These women know some of the men from high school or they meet new ones.

If you can't save now and not think for the future, no income will help. I seen most people try to save but they can't because of some weird karma.

A couple of problems with this example.Income is less than $15,000/year, just doing part time instacart and some income from dividends. But no debts, car and house are paid off. I simply sell stock when I need money.

It's possibe to have zero income, but be extremely wealthy and live off hundreds of thousands of dollars a year.

From what I understand, the rich borrow against their assets (such as a reverse mortgage for their house, or they borrow against their investments (e.g https://www.td.com/ca/en/personal-b...s-of-credit/investment-secured-line-of-credit).

Since this borrowed money has a lower interest at than what you would expect from your investments, you come out ahead. If you were to pull that money out from your rrsp or nonregistered investment account, you would pay about 25-30% in taxes. But since you are borrowing money, you pay zero taxes.

Example:

I have $500,000 in stocks. I borrow $100,000 using the investment as collateral, to pay for a lavish vacation and living expenses for a year. I have to pay 6% interest, so I pay $106,000 after one year.

Meanwhile after one year, that $100,000 that I did not take out would have earned me more than the 6% by keeping it in the investment account. So it ends up being a free loan.

However, if I had taken that money out of my rrsp, I would have had to pay $20,000 in taxes.

This is what Elon Musk and the other billionaires do all the time, and never pay income tax. They have very little income, but tons of assets to borrow against.

First, the bank won't lend you money against an asset without proof than you can make the loan payments.

They also won't let you use your RRSP as collateral.

Even if they did, at the end of year one, you have spent the 100k but still owe the bank 100k minus whatever you paid back.

After 5 years, you owe as much as the stocks are worth, the bank won't lend you anymore money and you're broke.

In his example he technically has no investments outside of RRSP so he has no dividend tax credits. He also has a 100,000 lifestyle so you would need an aweful lot of dividend paying investments to provide enough dividend tax credits that would offset income tax payable on 100,000 income and right now he has zippo.Unless of course you have enough dividend tax credits to cancel out the taxes from the RRSP income you've withdrawn (ignoring RIF stage of course). Depending on income, tax rate would be <5% for most years if you're $60K><$120Kish.

Taxes on death is another story, not my problem.

Also dividend tax credits would be used to offset partially the dividend income. You would have nothing left to offset any other income including RRSP income.

Well you are referring to 80 to 100K which is precisely his example of 100K.I was not addressing his example. I was addressing yours.

Not so. Feel free to spreadsheet it or go to taxtips.ca to do scenarios. Personal experience. $80K><$100K & <5% tax rate.

In any event I can't see how dividend tax credits can offset that much income.

I have plenty of Dividend paying investments and my dividend tax credit is nowhere close to offsetting much income.

I'll certainly check out taxtips.ca

This is excellent.At the most basic level (not really correct but for illustration)...

In Ontario the dividend tax credit is 25%. That is, 15% federal and 10% so total of 25%. So, say you make $60,000 dividends (about $1.5M investments). That's grossed up $60,000 x 1.38 to $82,800. You get a dividend tax credit of $82800 x 25% of $20,700.

At $82,800, your combined tax rate $49,231x 20.05%+ $4128 x 24.15%+ $29441x 29.65% for a total of $19,596.98 in income taxes. At this amount the tax you pay with the DTC is a wash. Add in Basic Personal Amounts as well as a few other smattering of credits and you can see how you can add RRSP/RIF income and still pay <5% tax.

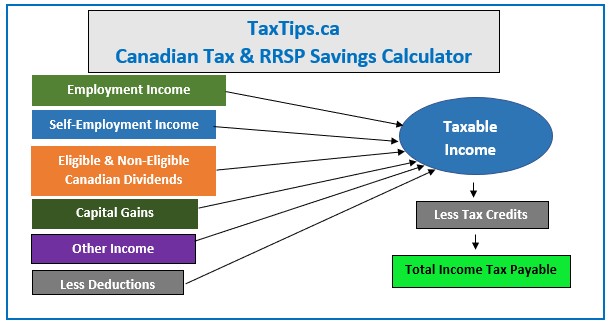

Using the detailed taxtips calculator

TaxTips.ca - 2024 and 2025 Canadian Tax Calculator

TaxTips.ca - 2024 and 2025 Canadian income tax and RRSP savings calculator - excellent tax planning tool - calculates taxes, shows RRSP savings, includes most deductions and tax credits.www.taxtips.ca

With $60,000 (actual) of eligible dividend income, the tax rate would be 3.22% for 2023. Add in another $15,000 of RRSP/RIF income, for a total income of $75,000, and your tax rate would be 5.4%.

Another example is $15,000 of capital gains (for a total income of $75,000) and your tax rate would be 5.32%.

You can see how you can play - for future planning purposes - with the mix of taxable, non-taxable (TFSA) and tax-deferred (RRSP) investments to determine your best/optimum retirement income. Add in other tax credits, carry over capital losses, as well as, say, pension splitting when this happens & if applicable, and you can see how you get to that lower tax rate.

Investing is not always about about how you put it in but sometimes more importantly how you withdrawal (yes, that was a joke, this is TERB).

Dividend income from Blue Chips should grow about 7.5% +/- a year so it can work quite well for a number of years**.

**note that dividends are quite tax-costly once you get beyond $150K-ish in income and capital gains become MUCH MUCH better tax-wise. But hey, $150K of retirement income is a good thing to have and not many people have to worry about that particular problem.

Next up; how to hide cash flow from the spouse to spend on SPs using RESPs.

A few things I wasn't aware of until now thanks to you.

I wasn't aware of the gross up. I am now.

I wasn't aware dividends are taxed at a different rate. I am now.

I still work 3 days a week for a salary of about $90K.

Yes, the joy of the non registered account DTC.

My wife is early retired. Most of her assets are in the non reg account.

We draw about 36K a year in dividends from there. We then intentionally trigger capital gains on enough to bring her taxable income to just under 70K when the marginal tax rates starts its next step. Last year she had to write a cheque for $4k for taxes owing for a paper income of 70K.

Her income is presently reinvested while I still work. The triggering of capital gains to raise the cost basis while her income is 'low' is being done while the taxable inclusion rate is still 50%. It could go up soon to pay for Justie's spendy ways.

Later when she starts on oas/cpp and RRIF income the chance to pay CG taxes at such a low rate will go away.

Yes, the joy of the non registered account DTC.

My wife is early retired. Most of her assets are in the non reg account.

We draw about 36K a year in dividends from there. We then intentionally trigger capital gains on enough to bring her taxable income to just under 70K when the marginal tax rates starts its next step. Last year she had to write a cheque for $4k for taxes owing for a paper income of 70K.

Her income is presently reinvested while I still work. The triggering of capital gains to raise the cost basis while her income is 'low' is being done while the taxable inclusion rate is still 50%. It could go up soon to pay for Justie's spendy ways.

Later when she starts on oas/cpp and RRIF income the chance to pay CG taxes at such a low rate will go away.

You will eventually take money out of your rrsp. Otherwise what's the point of having an rrsp? When that money comes out of rrsp it will be taxed as income.If you were to pull that money out from your rrsp or nonregistered investment account, you would pay about 25-30% in taxes. But since you are borrowing money, you pay zero taxes.

The borrowed money will eventually need to be paid back. Where is that money coming from? Your rrsp?

Money earned in an rrsp either dividends or captial gains are not taxed but will be when it's pulled out and that's taxed as income.

Dividends and capital gains in none registered accounts have tax advantages such as dividend tax credits and 50% of captial gains taxable. So isn't it better to have assets in non registered accounts rather that registered accounts from a tax standpoint?