Trans people should have their own division to eliminate any confusion.You talk about the left being obsessed with trans and gay rights while bringing up the topic of trans women in women's sports, with no provocation.

So is the left the one that is obsessed? No.

I voted today! - Vote early / vote often!

- Thread starter Ceiling Cat

- Start date

So tax the rich.IF one wants to keep our social programs - which we do - you cannot be a stupid dumb-ass with deficit spending.

hahahaha, yes, yes, until one cannot pay for it anymore. Our deficit is currently larger than our defense spending. You cannot LONG TERM take care of your population via social welfare programs if you're wasting tax revenue on debt interest payments.

Comparing Canada's debt to other country's is irrelevant. It's what Canada can afford long term.

The whole purpose is to avoid this...

Lessons from Canada's 'basket case' moment

In a rare interview, former prime minister Jean Chretien remembers the day Canada almost became the Greece of today. The story of how the country clawed its way back from pariah to fiscal darling is a lesson for both Europe and Washingtonfinancialpost.com

Finance officials bit their nails and nervously watched the clock. There were 30 minutes left in a bond auction aimed at funding the deficit and there was not a single bid.

“There would have been a day when we would have been the Greece of today,” recalled then-prime minister Jean Chretien, a Liberal who ended up chopping cherished social programs in one of the most dramatic fiscal turnarounds ever.

IF one wants to keep our social programs - which we do - you cannot be a stupid dumb-ass with deficit spending.

this is the part that I find so frustrating about the loonie left

they are adamite that social programs are essential to society and any threat to social programs must be resisted to the max

yet the biggest threat to the long term stability of government funded social programs is the irresponsible spending / irresponsible borrowing of loonie left governments.

i will add that here are some on the left who appear to want a government default/ collapse so they can claim capitalism does not work

Sure, the right wing is so good with finances that the only government that has had a surplus in Canada this century is liberal.this is the part that I find so frustrating about the loonie left

they are adamite that social programs are essential to society and any threat to social programs must be resisted to the max

yet the biggest threat to the long term stability of government funded social programs is the irresponsible spending / irresponsible borrowing of loonie left governments.

i will add that here are some on the left who appear to want a government default/ collapse so they can claim capitalism does not work

This is what you keep thinking is great.

Where did this guy Carney come from and why is he even being given a chance to become a PM ? 3 months experience as a politician, really? You guys need to re-examine your choice. This is a turf for politicians and not some bureaucrat.

Yeah, isn't that exactly why trump didn't get elected?Where did this guy Carney come from and why is he even being given a chance to become a PM ? 3 months experience as a politician, really? You guys need to re-examine your choice. This is a turf for politicians and not some bureaucrat.

the entire Trudeau crew had very low approval...they picked Carney because he was not exposed like freeland fraser Anand and Gould... had Trudeau got a decent rating, he wouldn't let go of that leadership...we will soon find out if the polls are right...you better show up and vote... Carney needs all the vote he can get.Yeah, isn't that exactly why trump didn't get elected?

How did Pee Pee go from polls saying a majority to polls saying he will lose his seat?the entire Trudeau crew had very low approval...they picked Carney because he was not exposed like freeland fraser Anand and Gould... had Trudeau got a decent rating, he wouldn't let go of that leadership...we will soon find out if the polls are right...you better show up and vote... Carney needs all the vote he can get.

Who do you call rich?Given "the rich" already pay significantly more than 20% of the taxes, please, feel free to define what is a 'fair' amount that they should be taxed. Do not forget, the bottom 40% already pay essentially no taxes.

Trudeau is right: 40% of Canadians don’t pay income taxes, which means someone else is picking up the bill

Ted Rechtshaffen: The top 20 per cent is likely paying 70 per cent or more of all income taxesfinancialpost.com

In fact, I INVITE you to define how much is fair and exactly how much more will be raised....

You REALLY REALLY need to get away from your NDP circle jerk with statements like this. Given I already know you're very misinformed over actual details and simple unable to do any sort of Grade 9 math or higher...good luck with answering.

Given that most of your information is US-based, don't be dumb and assume that the Canadian system is the same as the US system.

How about we start with the 1%

That 1% has 25% of Canada's wealth. You'd rather tax the bottom 40%, who own about 1% of Canada's wealth.

If you tax the top 10% of earners more, that'll provide enough to fix what is 'broken' in Canada.

Argentina and Brazil had or have populist leaders.Argentina, Greece, Brazil and many, many others fall into this category and yet, "It won't happen here".

Did they fix their 'broken' countries?

Wait, so that means you don't think anyone can change a country during a term in office?You have a real fixation with really, really short term history don't you? Anything longer than five years (or anything before 1948) you just draw a blank? What is it, drugs? Alcohol? Lifestyle? Early onset Dementia which explains why you vote NDP...

So why vote for anyone if its too short term for change?

I'm just pointing out places that elected leaders that did what you want to see how that worked out.

Clearly you know how poorly that fared but still want to do it again and again.

Amazing.So.

1) You (naturally) failed to answer the question. What's a 'fair' tax for the rich and how much revenue are you going to raise?

2) You're a dumbass once again. You have zero clue what it means to be a critical thinker. You just accept what you're told and repeat it.

Inequality is measured by the Gini Coefficient. You may have heard of it since the NDP Circle Jerk whines about it every two minutes. But here's the thing. MUCH like your misleading post that gives morons a hard on, they only talk about before tax income. BECAUSE we already tax the rich, provide a wide variety of social programs, taxes and income transfers, the GINI Coefficient for after-tax has not changed significantly in over 20 years.

Since you just have a LOVE for the US, lets start with US data. The (older) charge below shows US income inequality AFTER TRANSFERS AND TAXES has pretty much regained the same for 50 years. The later data hasn't changed much either.

Canada is very similar. Feel very free to search through Statistics Canada for the exact same information.

You lap up your misinformation because it serves a purpose, not because it's true.

View attachment 430612

So. What's this mean? This means you're clueless, have zero idea how to research, you never question what you've been told and I really don't' think you're capable, or even the critical thinking skills, of doing so. You much be the circle jerk leader....

You said it would be a failure to bring up american stats if I did it then you went and did it yourself.

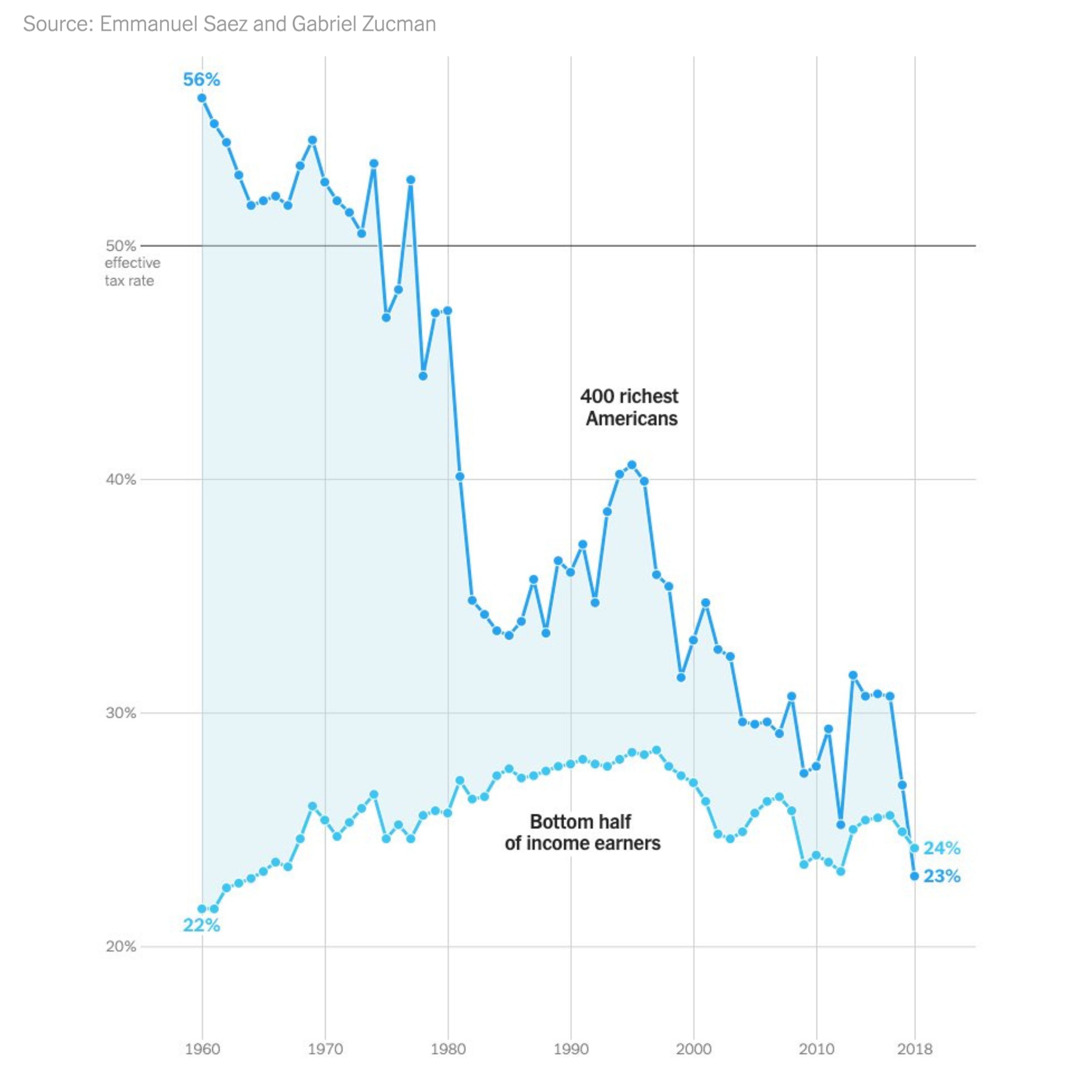

If you're doing american stats, then you need to go back to Reagan and trickle down shite, that is when the taxes on upper income earners started being cut and that is when the US became more divided and the infrastructure started falling apart.

You object to who is playing sports, therefore let's go Fascist?If the left side weren't so obsessed with trans, gay rights and making sure no one's feelings were getting hurt than Trump wouldn't have to get involved...who thought that biological men playing womens sports was a good idea?

That's a choice.

Wow, that's what you got from that?You object to who is playing sports, therefore let's go Fascist?

That's a choice.

Certainly seems to be your point, yes.Wow, that's what you got from that?

That is so true.

Surprising number of "The Liberals promote Genocide" signs and protesters on the way to the early voting place.

That surprised you?Surprising number of "The Liberals promote Genocide" signs and protesters on the way to the early voting place.

No one should vote for the NDP or Green party tbh. We need to give a clear majority if this country needs to move forward. Vote wisely….